SEBI News: Why SEBI Bans Short Selling, What Is Naked Short Selling, Means, Circular

On Friday, 5th Jan 2024 SEBI said investors across all categories will be allowed short selling, but not naked short selling means SEBI Bans.

Securities and Exchange Board of India (SEBI) Bans Short Selling.

friends, recently SEBI has announced a big update that is ear-popping in the world of capital. You might have questions regarding this, What Is Naked Short Selling? Why SEBI Bans Short Selling?, and also the meaning of Naked Short Selling. let’s first see what exactly SEBI is and what it works for.

Safeguarding the Interest of Investors

The Securities and Exchange Board of India (Sebi) plays an important role in regulating the securities market in the country. Established in 1988, SEBI functions as an autonomous body to protect the interests of investors, promote transparency, and ensure the smooth functioning of the Indian capital market.

Regulatory Framework

SEBI functions under the Securities and Exchange Board of India Act, 1992, and is given broad powers to regulate participants in the securities market, including stock exchanges, brokers, merchant bankers, and mutual funds Regulatory Framework Objectives For Investors It is to create a fair and environment that is transparent and encourages market development.

I hope you got a touch of what exactly SEBI is and how it regulates, Let further see what change and update it has done which is blowing the investor’s minds and going on a hype.

Read more: Ram Mandir Koradi Nagpur: This is the reality of Viral video that says this is Ayodhya Ram Mandir

Read more: Ram Mandir Jatayu News: PM Modi will inaugurate the Jatayu statue before the Ram temple?

Bans Naked Short Selling

On Friday, i,e 5th January 2024 The Securities and Exchange Board of India (SEBI) said investors across all categories will be allowed short selling, but not naked short selling. All stocks trading in the futures and options (F&O) area are eligible for short sales said the market regulator. SEBI said all investors must strictly fulfill their obligation to issue securities at the time of resolution.

According to market regulators ‘ policies on short sales, bank loans, and credit schemes, no institutional investors will ever be allowed to trade or diversify their businesses on certain days.

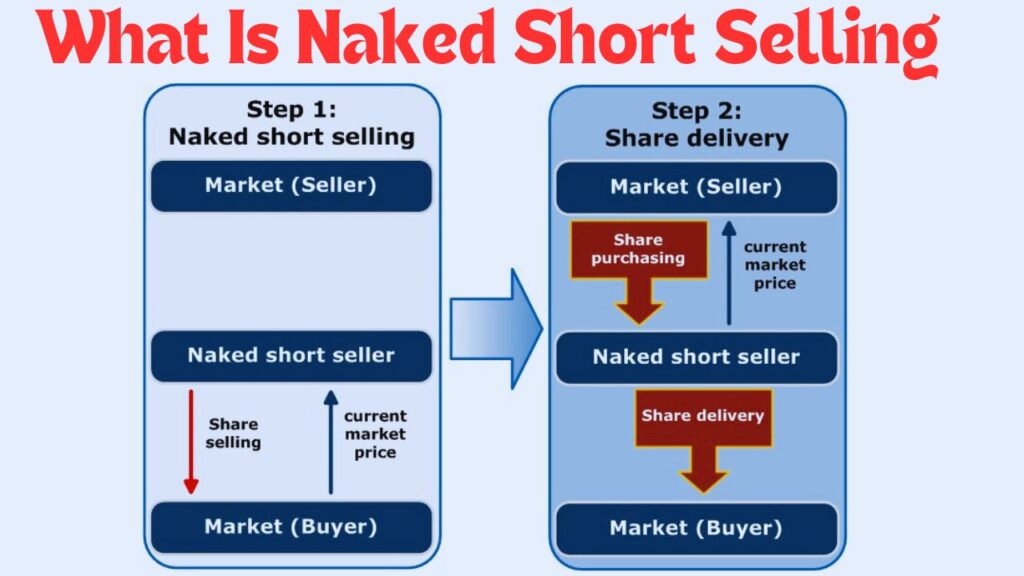

A short sale refers to the sale of stock that the seller does not own at the time of trading.

SEBI may review the list of stocks eligible for short sale from time to time as part of its stringent short sale disclosure rules, the market regulator said. “Stock exchanges will take the necessary uniform deterrent measures and take appropriate action against brokers for non-issuance of securities during settlement which will act as an appropriate deterrent against failed delivery,” SEBI said.

Adani’s Case

Before the report by the U.S. issued by short-seller Hindenburg Research last year came up, which showed that Adani group has broken the stock market rules. The Supreme Court had asked Sebi to investigate whether investors incurred losses and whether they took any illegal short positions. SEBI is investigating these allegations. The Adani Group has proved no wrongdoing.

FAQ: Why SEBI Bans Short Selling

Ans – It occurs when sellers short assets without borrowing them or securing that ability first.

Ans – It simply states that we can borrow and short sell stocks but one is supposed to reveal it while trading.

Ans – Naked short selling, or naked shorting, is the practice of selling short any marketable asset without first transferring the asset or checking its creditworthiness.

Ans – It is said that it will provide liquidity to the market and ensure artificial downward pressure on stock prices.

5 Comments